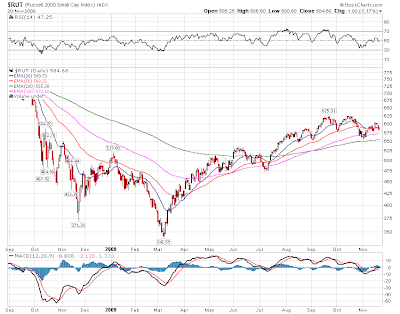

With the 65% rally in stock indices, the idea of actual reform of the financial system seems to have been put aside from serious consideration. Law and policy makers are instead holding out in hopes that 2008 was all just a bad dream, a rogue wave that nobody could have expected, or some sort of other metaphorical platitude designed to distract us from the reality of what happened.

Senator Chris Dodd introduced a bill that supposedly will reign in the financial industry. The bill would have been worth reading, and perhaps even worthy of taking seriously were it not over 1100 pages long. The length of the bill tells me everything I need to know - it is filled with loopholes, concessions, and incentives to ensure that any meaningful change can be interpreted away by the best cunning team of lawyers freshly printed money can buy.

Karl Denninger has a pretty good

takedown of the bill. That's not to say it's all bad. But the instances of actual reform (like eliminating regulatory arbitrage) will be outweighed by the damage inflicted by the perception of stability being falsely instilled in the minds of all market participants (ie. everyone). This is the single biggest problem I have with regulation. Lawmakers dance around pronouncing how safe and secure everything is, typically exaggerating such stability to make themselves look better, and people take their word (even if they know otherwise), knowing that it is someone else's ass on the line should all go awry. "Moral Hazard" in other words.

Ron Paul's "Audit the Fed" bill (HR 1207) is also under attack from partisans of the status quo. Mel Watt, a congressman from Bank of America's district, has put forward an amendment to the bill that essentially kills it dead. In politics, apparently you don't have to vote

against anything. You simply water down what you don't like to the point of making it meaningless. This way you end up with thousands of pages of laws that cancel each other out, confusing everybody except the aforementioned lawyers who's jobs rely on said confusion. Somehow I don't think this is what was in the minds of those who crafted our systems of government, but I digress.

The point is, despite all sorts of cage rattling, nothing is

actually being done. And there is mounting evidence that the opposite is happening: the institutions primarily responsible for the crisis have been given the keys to the city with the hopes that they rescue the system on their own accord. Good luck with that.

But as I implied earlier, doing nothing would be a better outcome than creating the perception of doing something while in fact doing nothing. That way, at least people would remain skeptical of the entire framework and reject its further expansion, thus reducing the potential damage.

But can we really expect anything that will actually have a stabilizing effect to be done given that almost nobody understands what caused the crisis in the first place? Obviously not. If you start with faulty assumptions, your analysis is bound to have faulty conclusions. Right now the assumptions are that:

- Banks were always well capitalized - it was just a lack of confidence that put them in jeopardy - and now that confidence is restored, everything will be fine.

- The lack of confidence caused people to save money - thus dampening consumption from its "normal levels" - and with enough "stimulus" there will be a disincentive to save, spurring consumption and helping boost GDP

- There was not enough regulation - new derivatives and bank activities managed to circumvent existing regulations - and with bigger or newer regulations these activities will be brought under control

- Pay incentives for financial executives encouraged unnecessary risk taking - changing the incentive structures for executives will help eliminate excessive risk

- The lack of a resolution authority was the reason why more big banks did not fail - the creation of such an authority will ensure systemic risk is limited

- The present financial system serves a social purpose by providing access to credit which encourages growth and prosperity

All of these assumptions are

false. And there are many others. The decisions being made now are based on these assumptions, and therefore their chance of success remains zero. Just as the avoidance of crisis was in 2007.

What are the real problems? The problems noted above and their accompanying "solutions" have one thing in common: they disregard debt (credit) as any sort of problem. This should come as no surprise, because

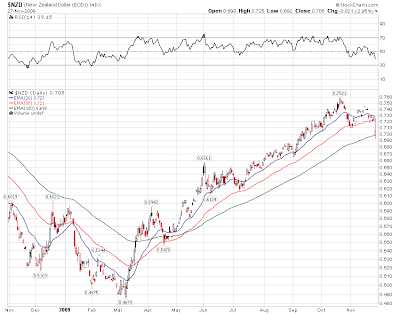

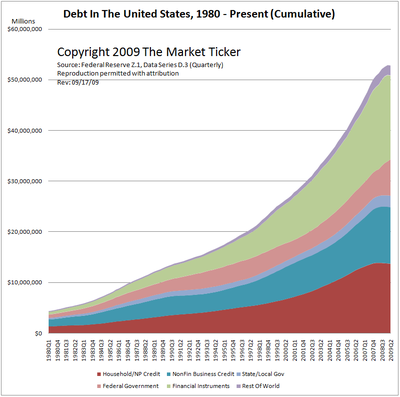

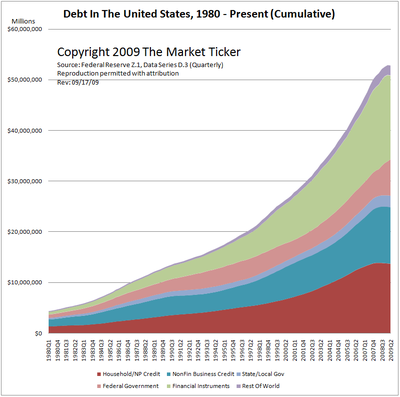

those who put forward their interpretation of the issues and those who seek to legislate solutions to them nearly all subscribe to economic ideologies that dismiss credit growth as potentially destabilizing for an economy. But credit growth is the central problem. And the inability for credit to grow further is what caused the crisis. Again, this was a mathematical certainty to occur at some point. One needs only a calculator and 6th grade math to reach that conclusion. When credit growth is compounded at annual rates between 6-15%, it does not take long for the parabolic advance to reach a breaking point. We reached that breaking point when our debt servicing to income ratio began to rise faster than our incomes and the equity in our primary assets (homes). Credit expansion slowed and asset prices, which had already priced-in years of future credit expansion began to be re-priced to levels more in line with our incomes.

Credit is the central cause of the crisis - the disease (if we are to characteristically resort to medical metaphors). The symptoms of the disease are many, a few of which are listed above. By addressing the symptoms we will not reach a paradigm of increased stability over the current system. It will be inherently unstable. Such has been the case for a century. And something that post-Keynesians like Hyman Minsky and many Austrian economists have been arguing for about as long. The only question revolves around what the "redline" is. What level of debt can be sustained by an economy? Of course, this depends on many factors: interest rates, income growth, productivity, etc. Because it is unknown at what level of debt an economy begins to "choke," we cannot say with 100% certainty that it has been reached. But we can make an educated guess, based on the events of last year, that we crossed that level.

Below is a chart of total public and private debt outstanding in the US. As you can see, total debt is now 4x the size of the entire economy - far more if one factors in unfunded future obligations or if one considers the guarantees issued for suspect financial instruments. (chart courtesy Market Ticker).

Economy bulls believe one of two things:

(1) Debt doesn't matter and this could continue rising for decades, or

(2) We can grow our way out of the problem via productivity advancements and income growth (I'm still yet to find anyone that feels this to be likely).

I have my eyes and ears peeled for any signs of (2), but I just don't see the necessary actions taking place to allow for this (deployment of savings on CapEx by businesses, competitive wages, proper demographic influences, etc). To the contrary. This economic "rebound" is not being led by productive deployments of capital, rather asset price speculation. This is the same reason that led me to believe that the '03-'07 expansion was mostly illegitimate. I was correct then, and I have no reason to believe my analysis was wrong and I just got lucky. The crash in asset values and seizure in credit that I hypothesized would be the result of an illegitimate expansion, happened - only more violently than I thought likely.

As I mentioned above, (1) is false and rooted in fallacious economic theory (Keynesian and Monetarist). While I suppose a temporary expansion of debt levels is possible (so long as interest rates remain low or continue falling, debt servicing ratios don't rise much), my intuition is that the max level was reached in 2008 and there will be neither demand nor supply of credit to allow for further expansion.

The combined factors above lead me to believe that we are on the cusp of another credit seizure and collapse in asset prices for the same reasons it happened last time. Such a collapse is unavoidable. The solution is to let it happen in an orderly fashion, in accordance with the law, and most importantly, with a viable framework for what a replacement financial system will look like once the unwinding is complete.

Discussion on what this system should look like need to begin immediately. If it is not in place prior to the unwinding of the current system, the unwinding runs the risk of being disorderly and vulnerable to being accompanied by the nasty side effects of such a disorderly collapse (ie. starvation, rioting, lawlessness, war, etc).

Simple Proposal For A Sound Financial SystemPrimarily, it needs to be acknowledged that unbacked credit expansion serves only the needs of a select few (the issuers) at the expense of everyone else. A future system shall make the extension of said unbacked credit a criminal offense. No new laws are required for this. Most western judicial systems have laws against counterfeiting, misappropriation and misrepresentation. As they are written, they need only be applied to the financial system as they are to any other person or industry. Lending anything that one doesn't already possess is a violation of all three laws.

With this one simple interpretive adjustment in the application of our current laws, we can eliminate

nearly every adverse symptom of our modern day economies (failure is not an adverse symptom, thus cannot be eliminated). In order to facilitate the above and to structre our financial system in a manner consistent with the law, the following would also prove necessary:

1) Convert all credit obligations for common equity

2) Liquidate the remaining debts that are not backed by existing equity

3) Eliminate legal tender laws

4) Financial institutions will elect to become one of three types of institutions:

i) Depository Institutions - The banks take deposits for safekeeping of a predetermined measure of deposit (dollars, gold, oil, wheat, land, whatever is accepted by the market) and facilitate electronic or physical transactions between like institutions. A fee is charged to depositors for these services.

ii) Lending Intermediaries - These institutions facilitate the matching of lenders and borrowers. A rate of exchange is settled by the two parties at the prevailing market rate. Should the borrower default, the lender experiences loss. The intermediary is responsible for the collection of regular payments and collateral in the event of default. A fee is charged for these services. No risk is ever taken by the intermediary.

iii) Investment Firms - These firms pool capital on behalf of willing investors and use it to speculate or invest on whatever they choose. Returns are based on entrepreneurial intelligence rather than who can take the most risk with borrowed money.

5) Eliminate regulatory redundancies (eg. capital ratios)

There is no social benefit in large, multi-purpose, ultra-leveraged financial institutions. Economies of scale in banking are typically left at municipal lines. Furthermore, our relatively new means of electronic transactions drastically reduces our need for indirect exchange (the use of money). Small transactions can easily be achieved with specie and dollars need only be retained as a unit of account. "Capital" will always be something tangible and the abolition of legal tender laws will encourage the monetization of more types of capital (primarily, the most irregular of commodities).

These changes are not an effort to tame or eliminate the business cycle. Not a "utopia." But it must be acknowledged that much of the business cycle we currently experience is due to the expansion of unbacked credit. Other business cycles will persist based on demographic, social and environmentally driven changes in values (among other factors). These cycles will most often be mild, but sometimes severe. But under the system outlined above, they need never be systemically jeopardizing. Success and failure should be embraced as equal sides of a smoothly functioning economy, neither embraced nor scorned. Yet failure that does occur will be on account of poor entrepreneurial judgement, rather than as result of others' excessive risk taking and systemic collapse.

I challenge the reader to explain coherently how our current financial system serves any greater social function than what I have briefly outlined here. And I furthermore request the reader to address the morality and logic of a financial system so complex as to be incoherent to the average person, while such a simple alternative presents itself.

If anyone has any details to add, I encourage you to do so in the comments section. I was purposely vague on certain areas of my "solution" so as to elicit further discussion.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). The author may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.