Well, Newsweek is claiming that the recession is over, and everywhere I turn, I hear debates not about whether the economy will recover in the second half, but rather how strong the recovery will be. Persistent job losses, reduced capital investment and stubborn consumption numbers do not seem to factor into the discussion. "They're lagging indicators," is the common retort to any negative news. Positive news, is, as always forward looking. So goes the sentiment game.

As I've often held, it's not the news that counts, but rather how people interpret it. Depending on the prevailing mood at the time, this morning's GDP report could have been seen as anywhere from terrible to wonderful depending on which components one chose to focus on. Therefore, it is more useful to focus on sentiment rather than data points.

Nowhere is sentiment more apparent than in China. It is taken as a given that Chinese growth is going to lead the world out of recession. Last year, the Chinese Communist Party told all of the banks to lend money immediately. And they did. The money has flown into real estate, stocks and commodities without regard to the borrowers ability to pay it back.

But people are starting to catch on. And they are seeing that China's miraculously resilient growth economy is both a) statistically manipulated and b) a short term oasis. If the masses catch on to this, the theme of an imminent return to global growth disappears as fast as it arrived.

This week, we've heard a number of China "experts" express their concern with how overheated the Chinese story appears to be getting in comparison with the reality on the ground.

Stephen Roach, head of Morgan Stanley's Asia division, wrote yesterday in the Financial Times:

China's Consumers Key to Revival

On the surface, China appears to be leading the world from recession to recovery. After coming to a virtual standstill in late 2008, at least as measured quarter-to-quarter, economic growth accelerated sharply in spring 2009.

A back-of-the envelope calculation suggests China may have accounted for as much as 2 percentage points of annualised growth in inflation-adjusted world output in the second quarter of 2009. With contractions moderating elsewhere, China’s rebound may have been enough in and of itself to allow global gross domestic product to eke out a small positive gain for the first time since last summer.

That’s the good news. The bad news is that China’s recent growth spurt comes at a steep price. Fearful that its recent economic shortfall would deepen, Chinese policymakers have opted for quantity over quality in setting macro-strategy, the centrepiece of which is an enormous surge in infrastructure spending funded by a burst of bank lending.

Sure, developing nations always need more infrastructure. But China has taken this to extremes. Infrastructure expenditure (including Sichuan earthquake reconstruction) accounts for fully 72 per cent of China’s recently enacted Rmb4,000bn ($585bn) stimulus. The government urged the banks to step up and fund the package. And they did. In the first six months of 2009 bank loans totalled Rmb7,400bn – three times the pace in the first half of 2008 and the strongest six-month lending surge on record.

This outsize bank-directed investment stimulus leaves little doubt as to how bad it was in China in late 2008 and early 2009. An unprecedented external demand shock, stemming from rare synchronous recessions in the developed world, devastated the export-led Chinese growth machine. That triggered sackings of more than 20m migrant workers in export-intensive Guangdong province. Long fixated on social stability, Beijing moved quickly with massive firepower to arrest this deterioration. The government was determined to do whatever it took to restore rapid growth.

Yet there can be no avoiding the destabilising consequences of these actions. Surging investment accounted for an unprecedented 88 per cent of Chinese GDP growth in the first half of 2009 – double the average contribution of 43 per cent over the past decade. At the same time, the quality of Chinese bank lending most assuredly suffered from the rash of credit disbursements in the first half of this year – a trend that could sow the seeds for a new wave of non-performing bank loans. Just this week Chinese regulators sounded the alarm – telling banks new loans must be used to bolster the real economy and not for speculation in equities and real estate.

A little over two years ago, premier Wen Jiabao warned of a Chinese economy that was becoming increasingly “unstable, unbalanced, uncoordinated and ultimately unsustainable”. Prescient words. Yet rather than act on those concerns by implementing a pro-consumption rebalancing, growth-hungry China was seduced by the boom in global trade and upped the ante on its most unbalanced sectors. By 2007, investment and exports accounted for about 80 per cent of Chinese GDP. And now, in the face of a severe global recession, China has compounded the very problems the premier warned of: aiming a massive liquidity-driven stimulus at its most unbalanced sector.

This is not a sustainable outcome for any economy – or sustainable support for the world economy. China must redirect economic growth towards internal private consumption. This may require a compromise on the quantity dimension of its growth outcome. But to the extent that leads to improved quality in the Chinese economy, a short-term growth sacrifice is well worth the effort.

Unlike most, I have been a steadfast optimist on China. Yet I am starting to worry. A macro strategy that exacerbates already worrying imbalances is ultimately a recipe for failure. In many respects, that’s what the global crisis and recession of 2008-09 are all about. China will not get special dispensation from the most critical lesson of this post-crisis era.

I agree that China will eventually become more of a consumer driven economy than it is now. But making an adjustment from their current economy to that of the future will take time and a rebalancing of the productive structure. This means that they will have to undergo a recession like any other nation. For China, however, it is possible that any slowdown in the pace of growth leads to such civil strife that the destination gets lost in the political struggle.

Along similar lines, Michael Pettis of Beijing University has been all over the stimulus programs and how they are lopsidedly effecting the economy in a very unsustainable manner. I highly recommend his blog for those interested in the intricacies of the China story.

And in addition to the above concerns about the outcome of these efforts, both Marc Faber and James Galbraith have come out this week contending that China's publicly available numbers are completely forged and not reflective of reality at all.

Courtesy of Ed Harrison of Credit Writedowns:

China’s economy is growing at 2 percent, not the 7.8 percent its government claims, says economist Marc Faber, publisher of the Gloom, Boom and Doom report.

“The Chinese government is one of the few governments in the world that knows its GDP numbers three years in advance,” Faber told CNBC.

“I’d be a bit careful about China.”

A growing number of investors turned bullish on China after its markets began to rise last March, Faber notes, adding that it’s possible Chinese markets will continue to rise for a while.

“If you throw money at the system, lots of things go up in value — but maybe they go up for the wrong reasons. What disturbs me today … is that the lows in March and late last year, sentiment was incredibly bearish about everything.”

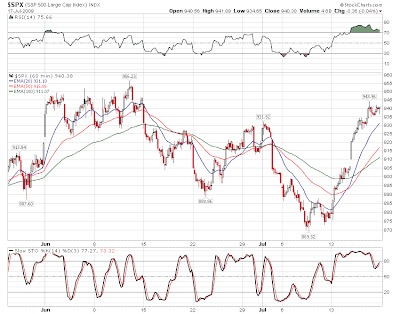

Now, Faber observes, “there’s this incredibly bullish sentiment when insiders are actually selling and the technical picture of the market doesn’t look that great.”

Faber believes the market faces headwinds because there’s a huge supply of available shares and a record number of new issues, which dampens share-price increases.

“My sense is that, near term, we could still have disappointments because now the mood is very optimistic. I don’t think we’ll make new market lows in Asia, but I do think we’ll have a meaningful correction.”

On Monday, China’s first initial public offering in nearly a year rose so high and so fast that regulators were forced to halt trading twice, The Washington Post reports. The Hang Seng index rose to double its low point last fall.

And Tyler Durden of Zero Hedge was reporting this morning on James Galbraith's report. He plucked out what he thought was the most applicable data:

It is no secret that China's economic numbers are so cooked and unreliable, that they make the constantly changing and optimistically biased economic data out of the U.S. (especially lately) have the credibility equivalent of a Harvard Ph.D. thesis. University of Texas professor James Galbraith discusses one aspect of China's "booming" economy, specifically the question of China's Trade Surplus, which as he notes has been drastically inflated since 2002 due to Chinese companies over-reporting profits on exports in order to disguise various investments by foreigners into China, so as to beat capital control restrictions.

Galbraith argues the "fake profits" are so large that China may have actually ran a trade deficit in some years, and these figures casts serious doubt on the reported P&L of Chinese companies.

Focal points in the attached presentation:

Slide 5: 2003-2006, 25% to over 100% overstatement of reported exports if you use constant unit values.

Slide 10-13: increase in reported export value is not due to price increases of exports to US, Japan, or EU.

Slide 17: increase in reported export value is not due to wage increases.

Slide 19: increase in reported export value is not due to quality improvements.

Slide 21: capital inflow suggested by drop in spread of 3-mo RMB repo's from 1.59% to (2.41%), and drop in spread of 3-mo CHIBOR vs LIBOR from 1.66% to (2.57%).

Slide 28: capital inflow seems to have gone into investments in PP&E. Slide 29: capital inflow seems to have gone into real estate investment

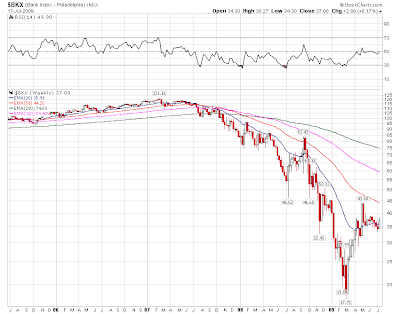

When the China bubble bursts, so will the hopes for global recovery. Until then...we dance.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). The author may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.